One thing I’ve noticed about my years in investing for retirement: Problems arise when everyone does the same thing.

Take your basic Standard and Poor’s 500 index fund. It’s taken as an article of faith that the easiest way for a 401K investor to diversify is to buy a S&P 500 fund. That way, you get the nation’s best companies all in one basket, right?

The problem is that the S&P has underperformed for more than a decade now. Why is that, exactly, if it represents America’s best large companies? Could this be — at least in part — a direct byproduct of the fact that everyone’s buying the same stocks?

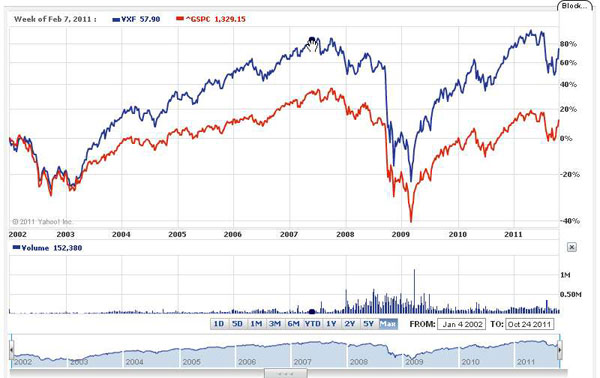

Take a look at this chart. The red line represents the S&P average since 2002. The blue line represents the average for the Vanguard Extended Market ETF, an exchange-traded fund designed to mimic the Standard & Poor’s Completion Index. That index basically consists of all market-traded stocks that aren’t in the S&P 500. Note how the ETF has done:

My current IRA consists of 10 or so large-cap stocks that pay significant dividends (with the exception of one stock — Apple), a broad bond index fund, a couple of growth-oriented small caps in which I’ve made small investments, and the above-mentioned Vanguard ETF. I might make 10 trades a year, if that. It’s doing quite well and, because of the exposure to the dividend stocks and bonds, it produces over 4 percent a year in cash. I’m happy with its performance.

An even easier way to go at that might be to drop the big individual stocks and buy a Dow 30 ETF. That gives you exposure to the biggest of the big caps and pretty much all of the mid- and small-cap offerings, but it scoops out a lot of the S&P stocks that are owned en masse by 401K funds.

My point is that you can get by in retirement investing with just a little bit of attention, but if you pay a little bit more attention, you can genuinely profit.